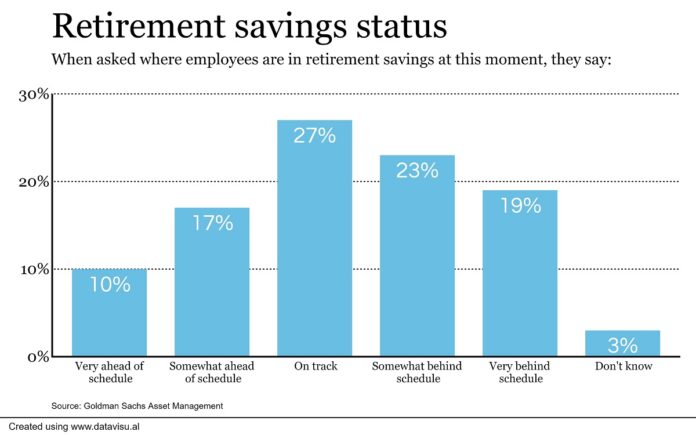

Confronted by a perfect storm of economic challenges, most employees aren’t saving enough for retirement because they are mired in what Goldman Sachs calls a “financial vortex.” And it’s information that makes clear HR has more work to do when it comes to helping workers improve their financial situations.

That vortex, which is shaking employee confidence, includes several factors that Mike Moran, senior pension strategist at Goldman Sachs Asset Management, says are “beyond individual control.” Those include pandemic-related financial challenges, recent market volatility, recession fears and soaring inflation, which has driven many employees to eliminate or decrease retirement contributions as they allocate their paychecks to other expenses.

Caregiving for family members—which has resulted in some taking time away from work, using some of their retirement savings or ceasing to save for retirement altogether—also is limiting retirement savings. All those reasons are on top of the usual factors that often hinder employees from saving, like credit card debt, starting a family and buying a home.

“The financial vortex is the new reality for retirement savers today,” Moran says. “It’s not a question of if, but when, someone will be impacted. Knowing how to adapt to keep retirement savings on course is key to navigating these challenges. The longer an investor remains off-track, the larger the adjustments may need to be to fully course-correct. But more likely, we believe some will retire with insufficient savings and need to adjust their retirement lifestyle and expectations, accordingly.”

The increasingly important role of employers in retirement and other parts of financial wellness will be a central part of the agenda for HRE’s 2023 Health & Benefits Leadership Conference, which will be held from May 3-5 in Las Vegas. Learn more and register here.

The Goldman Sachs report finds that all generations of Americans have been “significantly impacted” by competing financial priorities and life events that have derailed the ability of many to save for retirement. Older employees are feeling the pain even more: More than half (53%) of working Baby Boomers and 51% of Gen X respondents say they are behind in their retirement savings. Furthermore, only 11% of working Baby Boomers and 12% of Gen X are “very confident” in meeting their retirement goals. Another 40% of working Baby Boomers and 32% of Gen X respondents are just “somewhat confident,” while 30% of working Baby Boomers and 40% of Gen X expressed concerns about meeting their goals.

The Goldman Sachs report finds that all generations of Americans have been “significantly impacted” by competing financial priorities and life events that have derailed the ability of many to save for retirement. Older employees are feeling the pain even more: More than half (53%) of working Baby Boomers and 51% of Gen X respondents say they are behind in their retirement savings. Furthermore, only 11% of working Baby Boomers and 12% of Gen X are “very confident” in meeting their retirement goals. Another 40% of working Baby Boomers and 32% of Gen X respondents are just “somewhat confident,” while 30% of working Baby Boomers and 40% of Gen X expressed concerns about meeting their goals.

Some better news from the financial services firm’s report is that younger generations are faring a bit better: Just 34% of millennials and 27% of Gen Z respondents report being behind schedule in their retirement savings. Additionally, 31% of millennials and 31% of Gen Z are “very confident” they will meet their retirement goals, while just 19% of millennials and 12% of Gen X expressed concerns.

Almost four in 10 (39%) millennials and 47% of Gen Z increased retirement savings over last year, while 32% of Baby Boomers and 33% of Gen X decreased theirs.

The report also finds that during the COVID-19 pandemic, 14% of working Baby Boomers, 25% of Gen X-ers, 33% of millennials and 32% of Gen Z respondents said they withdrew money from their 401(k) plan without penalty to cover expenses.

The Goldman Sachs retirement report is the latest to paint a bleak picture of retirement. A recent report from the nonprofit Transamerica Center for Retirement Studies in collaboration with Transamerica Institute finds that employees’ retirement savings—and emergency savings—are still falling short, driving many workers to plan to keep working past retirement age. And Morgan Stanley recently reported that nearly a third of employees have reduced contributions to their 401(k)s.

In general, market volatility has caused retirement balances to drop, deflating confidence among many employees, while cost-of-living increases have driven scores of workers to decrease their retirement contributions.

That pessimism gives employers an opportunity to make strides when it comes to helping employees with retirement and other financial issues. Organizations can help by providing robust retirement and financial benefits, communicating said benefits and encouraging workers to stay the course with their savings—even during turbulent economic times. Employers can also consider boosting contributions to their employees’ retirement accounts or offering emergency savings programs, experts say.

In fact, recent data from Morgan Stanley at Work revealed that compared to last year, employees are paying more attention to their financial and retirement benefits and are looking to their employers for expanded resources and guidance.

“Employees are looking to their employers to provide support as conversations around financial wellbeing continue to gain traction,” Brian McDonald, head of Morgan Stanley at Work, recently told HRE.