This month, HRE is helping HR leaders prepare for the year ahead with a series featuring insights from industry experts, thought leaders and others about what we can learn from 2020 and the challenges coming in 2021. Read the series here.

*

This year has brought HR a host of unprecedented issues to navigate: employee safety concerns, engagement in a newly remote world, legal considerations and even the reshaping of the HR role itself. With all of that change just in the last few months, many HR leaders are looking to 2021 with a bit of trepidation: What’s next?

For Greg Wilson, head of workplace solutions at Ayco, a Goldman Sachs Company, 2021 should be a time for HR leaders to reassess their benefits offerings, particularly in light of employees’ growing financial and mental health concerns. Wilson, whose company counsels more than half of the Fortune 100 on corporate benefits, recently shared his thoughts with HRE about what’s coming down the pike for HR next year.

HRE: How did the challenges of 2020 impact how organizations approached employee financial wellness this year? How will that continue to evolve in 2021?

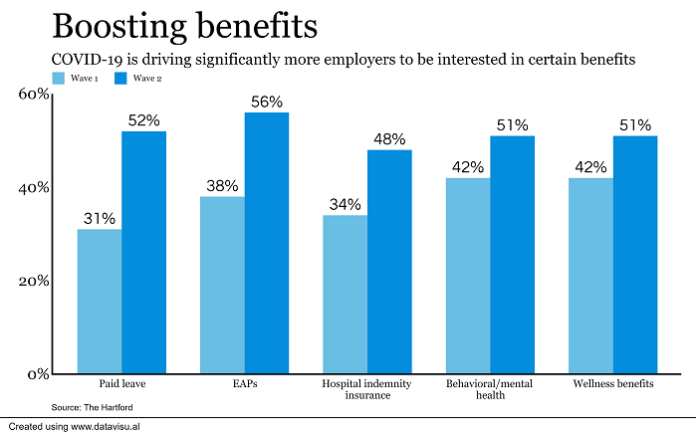

Wilson: This year has elevated the need for employer-provided financial wellness resources. As employers had to furlough or lay off employees, they quickly discovered that many employees did not have emergency funds or other savings to fall back on in these situations. In response, employers looked to immediately leverage support available through current wellness vendors, including any existing financial wellness programs, EAP or retirement plan administrator.

In addition, we’ve seen many employers adding or enhancing financial counseling benefits to assist with budgeting, investment planning, voluntary early retirement offers and support for survivors. As most companies had not planned or budgeted for these much-needed financial counseling benefits this year, we’ve worked with many corporate partners on some creative methods to quickly implement new programs. Given the positive employee feedback and increased employer focus in this area, we expect an increasing number of employers to budget for new and expanded financial wellness programs in 2021 and beyond.

HRE: What should be HR leaders’ first priority for 2021?

Wilson: As we head into 2021, employers should focus on benefits to support overall employee wellness.

Many employers have added and/or enhanced benefits through the pandemic to assist employees with child- and elder care, mental and emotional health issues, and the increased need for flexibility and paid leave. For 2021, employers should consider focusing on more permanent solutions for helping employees handle the stress and anxiety of the pandemic and increased work/life balance struggles.

In addition, employers should look for ways to assist employees in getting back on track with respect to short- and long-term savings. Many employees took advantage of CARES Act loans or withdrawals from their 401(k) plans this year and discontinued savings into the 401(k) due to cash flow issues or because their employer suspended matching contributions. Financial wellness coaching can help these employees get back on track by working with them to develop a plan and budget for repaying any 401(k) loans or withdrawals, resetting their 401(k) savings and rebuilding emergency savings.

Click HERE to take HRE’s survey, What’s Keeping HR Up at Night?

Employers will also be focused on how to get employees safely and comfortably back to the office. Safety protocols, restructuring of workspace and transparency of information will be critical elements. Employers may consider providing access to testing and vaccination, keeping employees informed of potential exposures and allowing the flexibility for employees to make their own decision about returning to the office.

HRE: What HR technologies and applications should vendors be working on right now? Why?

Wilson: As employers look to support their employees’ wellness needs through these uncertain times, virtual tools and resources are critical. These include:

- Mental health apps: As behavioral health issues including anxiety, depression and substance abuse are continuing to rise, vendors should look to develop applications that provide helpful tools to employees like stress management exercises, access to virtual counseling and telehealth visits.

- Caregiving resources: The need for childcare resources continues to grow as many caregiving facilities and schools are still at least partially closed. Applications to assist in finding caregivers, creating nanny-sharing and learning pods, and virtual learning platforms are invaluable resources for working parents.

- Budgeting/money tracking apps: Many employees have struggled with job loss and reduction in wages this year. Financial tools such as digital education platforms, budgeting tools and money-tracking applications can help employees manage their income and expenses, find resources for assistance and develop long-term savings strategies as their financial situation changes.