41: Percentage of Americans who say not having enough emergency savings is their top financial concern right now

According to a new survey released by the National Endowment for Financial Education, not having enough emergency savings is Americans’ top financial concern during the coronavirus pandemic. Other top concerns include job security (39%), income fluctuations (29%) and not having enough saved for retirement (23%). Overall, the organization found that 88% of Americans say the COVID-19 crisis is causing stress on their personal finances.

What it means to HR leaders

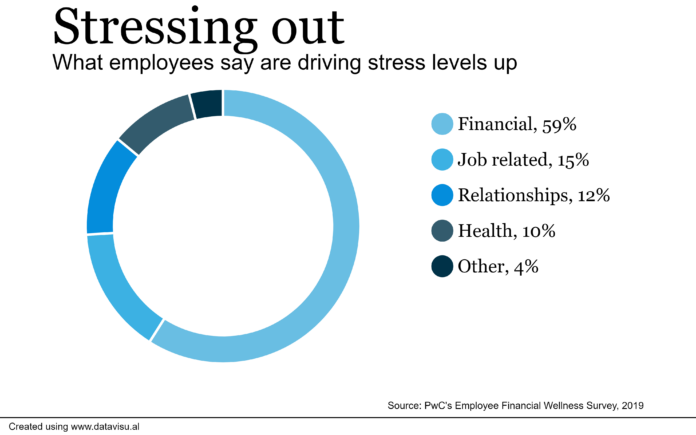

The survey is the latest to underscore employees’ financial concerns during the coronavirus pandemic. Other research from Optum also emphasized employees’ financial concerns, indicating the importance of workplace financial wellness programs that can encourage smart behaviors and ease financial stress.

The NEFE findings, though, put a spotlight specifically on the importance of emergency savings accounts, which historically have not been a top priority for employers. Access to emergency funds is one of the biggest pieces of financial health, and helping workers build their savings is actually one of the simplest things to do, Melissa Gopnik, senior vice president at Commonwealth, a Boston-based financial nonprofit, recently told HRE.

“Half of the people in this country don’t have an emergency fund, and it’s just mind-boggling,” she said. “Everyone you talk to knows they should, but it’s hard.”

Doing so by encouraging employees to use a split deposit–which can put some of a worker’s paycheck directly into a savings account–can make a significant impact on the workforce, Gopnik says.