The cost of healthcare benefits around the world will–on average–remain steady in 2022, according to a new report from Willis Towers Watson, but that fact is deceptive, hiding considerable volatility expected in global healthcare use and costs.

Despite the average cost stability from 2021 to 2022, Willis Towers Watson’s 2022 Global Medical Trends Survey uncovered sizeable variation in predictions for cost increases by region, based on COVID-19‘s surges in different countries at various times since March 2020. That asymmetrical arc around the globe is creating volatility, according to Eric McMurray, global head of health and benefits at Willis Towers Watson.

For example, insurers expect costs to increase as much as 14.2% in Latin America next year, and U.S. costs are projected to increase by 7.6%, according to the firm’s National Trend Survey.

Related: How employers hope to contain rising healthcare costs for 2022

Survey respondents anticipate price increases of 10.6% in the Middle East and Africa, 7.6% in the Asia-Pacific region and 6.7% across Europe. Looking ahead, medical insurers also expect healthcare costs to accelerate beyond 2022, with over three-quarters projecting higher or significantly higher costs over the next three years.

“COVID-19 has produced the biggest impact to global medical trend variation the industry has seen, and we expect the repercussion and volatility from it to extend into 2022 and beyond,” says McMurray, adding that countries and employers are feeling the impact differently. Some have experienced the recovery’s demand for regular medical services in 2021, while others will see it next year or even later.

“COVID-19 has produced the biggest impact to global medical trend variation the industry has seen, and we expect the repercussion and volatility from it to extend into 2022 and beyond,” says McMurray, adding that countries and employers are feeling the impact differently. Some have experienced the recovery’s demand for regular medical services in 2021, while others will see it next year or even later.

“The pandemic, combined with the changing face of work, has had a significant effect on medical trends, delivery of services and the future drivers of medical claims,” he says.

COVID-19 and its impacts have helped accelerate telehealth services, according to the survey, thanks to the savings that can come from virtual healthcare. Over half of global insurers now offer telehealth across all plans, and nearly four in 10 insurers (37%) identified the addition of telehealth services as the biggest change to their medical portfolios in 2021.

“Telehealth’s momentum will be sustained post-pandemic. In fact, the role of telehealth will continue to evolve not only as a navigation tool to speed access to the right care but also as a means to close gaps in access to care,” says Francis Coleman, managing director, Integrated & Global Solutions, Willis Towers Watson.

Seventy-five percent of survey respondents said using contracted networks of providers for all treatments is the most effective method for managing medical costs; preapproval for scheduled inpatient services (67%) is the second most efficient cost management tool. Telehealth (63%) jumped to the third spot, up from No. 5 last year, a sign that more insurers see potential savings from remote options for diagnosing and treating patients.

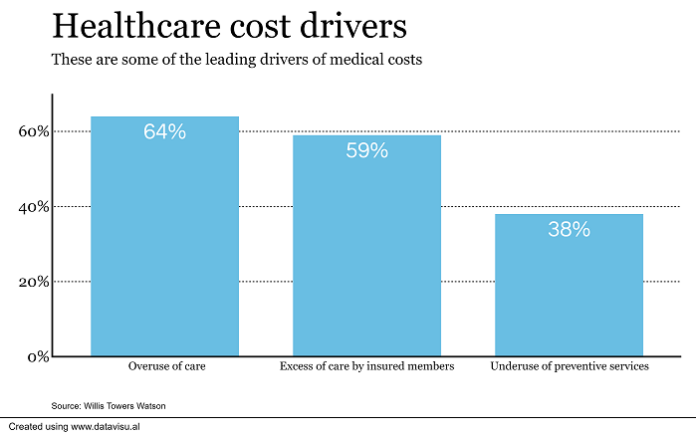

The leading driver of medical costs continues to be overuse of care (64%) due to medical professionals recommending too many services or overprescribing, according to the survey. Excess of care by insured members (59%) is the second leading driver, while underuse of preventive services (38%) is also a significant cost driver and increased year-over-year due to, in part, the avoidance of medical care during the pandemic.

Insurers named cancer, cardiovascular and musculoskeletal as the top three conditions by cost, identical to last year’s findings. Interestingly, respondents ranked musculoskeletal as the top condition by the number of claims this year; they ranked it fifth last year, possibly due to poor ergonomics in work-from-home environments.

“COVID-19 has caused volatility in the trend numbers and in the leading causes of claims, as the sedentary lifestyle that often accompanies working from home has increased the risk of musculoskeletal injuries,” Coleman says. “In addition, as most employers can attest, mental health claims are also on the rise.”

“COVID-19 has caused volatility in the trend numbers and in the leading causes of claims, as the sedentary lifestyle that often accompanies working from home has increased the risk of musculoskeletal injuries,” Coleman says. “In addition, as most employers can attest, mental health claims are also on the rise.”

And the rising cost of global medical coverage will affect US employers, Coleman says. These expenses used to be a fraction of US costs, she says, but continued high demand for private healthcare from global employees–due to reduced coverage or access under social systems–and the double-digit increase expected in many countries are driving those costs are moving closer to US levels.

“With that, the medical spend is growing rapidly outside of the US and it is becoming a larger and larger part of [an organization’s] overall rewards budget,” she says. “This accelerating medical trend also has a secondary effect on other parts of the compensation budget, such as merit pay increases. Consequently, U.S. employers need to be vigilant on their worldwide medical spend, not just their US budget.”

The 2022 survey was conducted from July through September with 209 insurers in 61 countries.