Persistent inflation and the high cost of new medical technologies are among the drivers that will contribute to another year of sharply rising global healthcare benefits costs in 2024, according to the WTW Global Medical Trends Survey released this week.

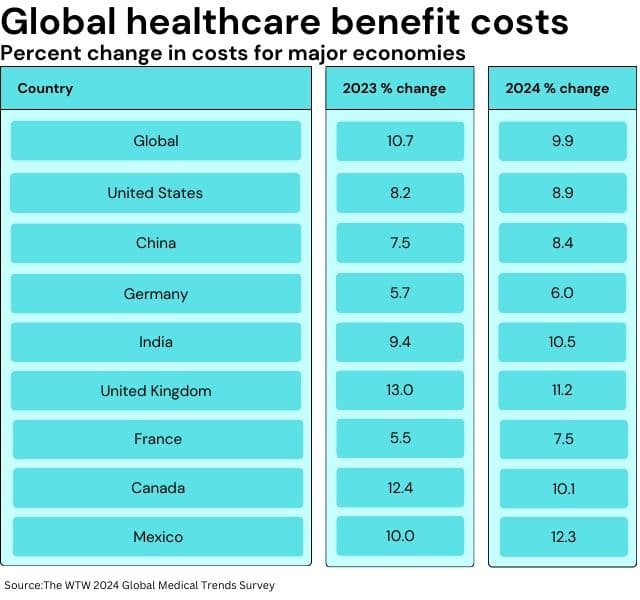

These factors are among several that are expected to push healthcare benefits costs for employers up 9.9% in 2024 compared with this year. That jump will come close to the record-high increase of 10.7% in 2023 and substantially surpasses the 7.4% rise in 2022, according to the report, which queried 266 insurers representing 66 countries in July.

“Employers are facing both higher cost increases as well as the potential for significant volatility, making it even more difficult to budget and plan,” according to Debby Moorman, head of Health & Benefits for WTW’s North America region.

Related: U.S. employers to see health benefit costs soar again in 2024

Here’s a look at the causes of this continued pressure on employers and some steps organizations can take to minimize the impact.

Drivers of rising healthcare benefits costs

High global inflation rates, although lower than the record high of 8.7% in 2022, remain a top catalyst for increasing healthcare benefit costs because they are expected to remain well above pre-pandemic rates next year, according to WTW’s report. The report puts the 2024 expected inflation rate at 5.8%, well above the 3% rate typical before 2020.

Continuing geopolitical conflicts also affect healthcare benefit costs, according to Linda Pham, senior director of integrated and global solutions at WTW. These global conflicts leave displaced populations seeking care in new regions, increasing the need for medical support in these locations and straining the available providers.

According to the survey, insurers also cite these behavioral causes of rising costs next year:

- Overuse of care because of medical professionals recommending too many services or over-prescribing medication, cited by 59% of respondents.

- The high cost of new medical technologies (57%)

- Employees’ poor health habits (49%)

- Lack of integration between primary, specialty and facility care providers (48%)

- Underutilization or lack of preventive services (47%)

Against this backdrop and with some economic experts still predicting a recession in the coming months, employers need to act to keep costs under control, Moorman says.

She advises HR leaders to understand the risks within their workforce, such as the frequency and severity of health-related issues like obesity, and to review their current healthcare offerings to ensure they receive the best value. Moorman also suggests exploring strategies to balance the pressure of rising healthcare benefits costs with employee experience needs.

“By understanding the factors that affect healthcare and drive costs in their populations,” Moorman says, “employers can effectively combat the ever-present threat of rising costs.”