As HR leaders finalize their 2026 benefits strategies, industry experts are forecasting shifts driven by economic pressures, generational divides and evolving employee expectations. From the rise of budget-conscious health plan selections to demands for life-stage-specific benefits, the coming year will challenge organizations to balance cost containment with meaningful support for an increasingly diverse workforce.

Migration to lower-cost options

Economic realities are reshaping how employees approach health insurance selection, according to Ben Light, VP of partnerships at ICHRA platform Zorro, who predicts a surge in Bronze plan enrollments as workers feel the squeeze of persistent inflation and cost-of-living pressures.

“We’re seeing a fundamental shift in how employees think about their health coverage,” says Guy Ezekiel, Zorro’s co-founder and CEO. He also anticipates continued migration to lower-premium plans, driven not just by budget-conscious employees, but also by tighter employer allowances. The result? More sophisticated plan selection behavior as workers learn to balance premium savings against higher deductibles.

This evolution goes beyond traditional insurance models. Light predicts growth in direct primary care (DPC) and reference-based pricing. Reference-based pricing is a healthcare payment model that sets reimbursement rates for medical services using a predefined benchmark rather than the provider’s billed charges. He also expects an increase in direct provider contracting, led by innovators such as Mark Cuban’s Cost Plus Drug Company.

Ezekiel sees this manifesting in the form of hybrid strategies that blend traditional insurance with health savings accounts, DPC and telemedicine. This shift has implications for HR leaders, as employees will increasingly depend on AI-powered decision-support tools to choose and optimize their benefits.

He says this means HR teams will need to invest in technology and education that help workers understand and navigate complex trade-offs.

Transparency and PBM scrutiny

The demand for transparency around drug and care costs will intensify in 2026, Light predicts, with pharmacy benefit managers facing particular scrutiny as the “spread”—the difference between what PBMs charge employers and what they pay pharmacies—becomes more exposed to public view.

This scrutiny aligns with broader efforts to control healthcare costs, including rising employer investment in niche off-exchange plans.

Meeting multigenerational needs

Experts predict that in 2026, HR leaders will face increasing challenges as generational differences in benefits priorities grow and universal approaches become less effective.

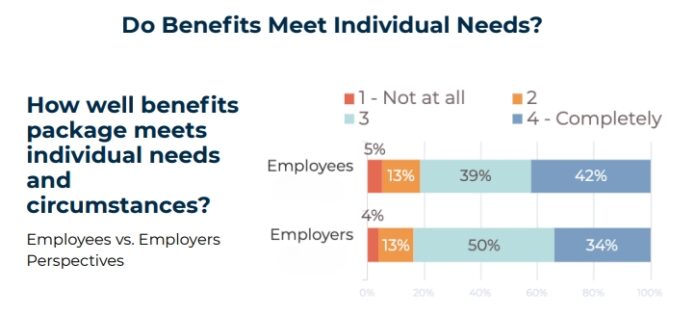

“Companies can’t guarantee that the benefits they offer will address the specific needs of every individual employee, but they can build offerings that are meaningful for every generation,” says Doug Sabella, CEO of Payroll Integrations, a payroll API built for benefits. “The pressure to deliver these personalized benefits will only grow in 2026.”

A recent study of employees and HR leaders by Payroll Integrations offers insight into the differences in what each generation values:

Gen Z (ages 18-27)

62% want health insurance as their top unmet benefit, while 46% have already withdrawn from retirement funds, signaling a need for better financial guidance alongside benefits offerings.

Millennials (ages 28-43)

43% prioritize fitness and wellness offerings, with 93% placing greater responsibility on employers to fill financial support gaps not met by government programs.

Gen X (ages 44-59)

43% focus on additional compensation, with 80% expecting employers to provide financial support beyond government programs.

Boomers (ages 60+)

27% emphasize retirement plans and pet insurance, with 64% looking to employers for supplemental financial support.

With such a generational divide, a universal benefits program will not work for employees in 2026, Sabella emphasizes. “While today’s economic environment has kept many employees in their roles longer than expected, a growing number will start to reconsider over the next year,” he says.”Benefits will be a big consideration of whether they choose to stay or go.”

Read more: 3 strategies to drive success with your benefits technology

Addressing critical life stages

Beyond generational differences, 2026 will demand greater attention to specific life-stage needs, particularly for working parents and women navigating menopause.

Dr. Roger Shedlin, CEO and founder of WIN, a fertility and family-building benefits company, points to a gap. He says 80% of parental support needs remain unmet by current employer benefits and health plans.

“Integrated solutions that address pediatric care holistically enable working parents to seamlessly navigate every stage of childhood without compromising their work performance or dedication to their families,” Shedlin says, highlighting the need for comprehensive support that goes beyond traditional maternity leave.

According to Shedlin, it is also essential for employers to provide benefits that meet the needs of women as they age and enter menopause, including behavioral health support, clinical guidance and evidence-based treatment options.

He says the business case for menopause benefits support is compelling. Stanford research shows that women who seek medical care for menopause symptoms earn 10% less four years later, often because they reduce hours or quit.

The Mayo Clinic has estimated that U.S. businesses lose $1.8 billion in work time due to menopause symptoms. “Providing benefits that support this phase of life for women is not only a necessity and value-add for working women, but also for the organizations that employ them,” says Shedlin.