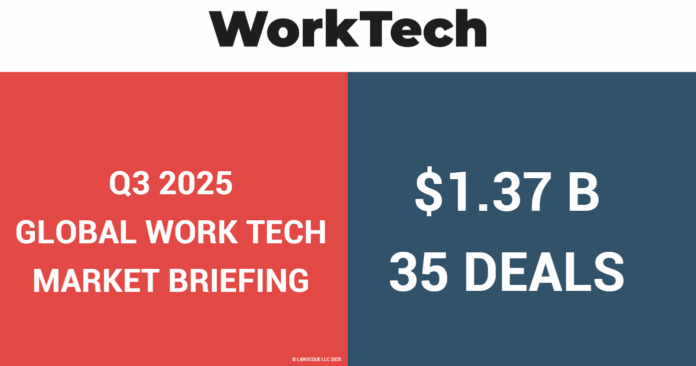

Investors poured $4.93 billion into HR and work technology through the first three quarters of 2025, a 20% increase over the same period in 2024, according to WorkTech’s Q3 2025 Global Work Tech VC Report. The third quarter saw $1.37 billion invested across 35 deals, with four mega-deals exceeding $100 million. So far, the year has included 15 mega-deals, four of which hit in the most recent quarter.

As George LaRocque, founder of WorkTech, notes in the report, there are “early signals across several emerging sub-categories.” The third-quarter data reveal that the following four categories drew significant capital and early-stage investment activity.

Compensation intelligence gains traction

Compensation platforms drew three early-stage investments, part of what the report identifies as growing interest in “compensation intelligence and pay equity” tools. The category captured $37.8 million across two deals.

The early-stage focus suggests investors see opportunity in tools that go beyond traditional salary surveys. Pay transparency laws expanding across states, as well as changing disclosure requirements in Europe, are creating demand for real-time market data and modeling capabilities.

HCM technologies (which include compensation tools) captured over 50% of total deal volume and the majority of funding, maintaining what the report describes as a “multi-year lead.”

Benefits technology attracts the largest deals

Benefits platforms totaled $357.9 million across three deals, making it the second-largest by capital raised. This segment also secured two of the quarter’s four mega-deals. The report highlights a divergence in benefits-tech investments, with major platforms growing in scale and smaller entrants sharpening their specializations.

Judi, a platform to help employers design and manage health benefit programs, raised $252 million in a Series F round. Benefits administration and HR software platform Employee Navigator closed a $100 million private equity investment. The mega-deal activity signals investor confidence in employer benefits as a retention tool. With healthcare costs rising, platforms that simplify administration while improving employee experience are drawing significant capital.

Read more: HR Tech 2025 takeaways from investors and start-ups

Candidate tools see early-stage activity

WorkTech clocked five early-stage investments in candidate tools concentrated in sourcing, screening and scheduling. The report highlights this as part of a broader transformation in talent acquisition, where “AI screening reshapes candidate experience.”

Digital interview platforms raised $18.16 million across two deals, while marketplace job board technologies captured $24 million in a single deal. The talent acquisition category overall saw limited volume, but what the report describes as “signal-rich” activity, suggesting emerging opportunities. The focus on early-stage deals rather than established ATS vendors suggests investors see an opportunity for new entrants to reimagine recruiting workflows.

Payroll evolves beyond processing

Payroll technology raised $257.6 million across four deals. Earned wage access provider Earnin secured $225 million in debt funding, one of the quarter’s four mega-deals. This milestone represents the third-largest transaction this quarter, after isolved’s $350 million secondary and Judi’s $252 million Series F.

LaRocque notes investment is flowing to platforms embedding financial wellness tools rather than traditional payroll processing. The shift reflects growing employer interest in helping workers achieve financial security, not just timely payment.

HCM maintains dominance

Human capital management technologies captured nearly 90% of Q3 capital, continuing to dominate work tech investment. The category raised $390 million from HR suite/platform deals alone, led by a $350 million continuation fund by Accel-KKR to maintain its stake in iSolved.

LaRocque observes that “these areas reflect growing investor interest in infrastructure that supports workforce agility, personalization and distributed workforce dynamics.” The report notes investors favor “platform depth over surface-level innovation.”

The numbers suggest HR technology has weathered broader economic uncertainty, with year-to-date investment up more than 20% over the same period last year and 15 mega-deals signaling continued investor confidence in the category’s long-term potential.